Why am I giving you a scenario where real estate prices in India crash? It might seem unthinkable but its possible. Read on about prices can affect returns on your real estate investment. I have provided a free Excel download at the end of this article. I urge you to read this article and download the Excel to see how this works yourself.

If you are not familiar with the working of a home loan I recommend that you read an earlier article at Capital Orbit.

Real estate prices

All of us know somebody who made a fantastic return by investing in real estate in India over the last decade. With increasing disposable income and wealth, people have started buying second homes as real estate investments at relatively younger ages as compared to the generation before us. The success stories are so many that one cannot help but feel that real estate prices will only go skyward.

But if you look to the past you will see that real estate prices can fall. They fall in a slow and grinding way which can test your patience and can leave you with losses if you want to exit your real estate investment

India real estate price trend

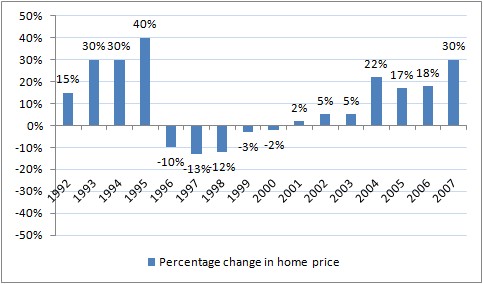

I have created a chart from data that I found in a Centrum research report for percentage home price changes between 1992 and 2007 in India.

As you can see prices like a roller-coaster ride. The real estate market had great gains post-liberalization in 1991 only to give a bleak period for 6 years starting 1996.

How to use the Excel for studying real estate investments

This page has an embedded Excel file that you can work on right now.

Some general instructions are as follows. Only change the assumptions in green. For simplicity I have assumed a home price of Rs. 1000. Enter the year of purchase and year of sale as I have described in the scenarios below. The Excel will give proper results for years between 1992 and 2007. Take care to enter years only in this range. You will also need to change Owner Contribution which is also marked in green.

If you are ready to go, scroll down, have a look at the Excel and come back here to Case 1.

Our practical study starts now.

Case 1

Take a case where there is no home loan to finance the real estate investment. Set Owner Contribution to 100%. Automatically loan will be set to 0%. Take year of purchase as 1996 and year of sale as 2002. Scroll down in the Excel to see your returns in the cells marked in yellow. The investor sits on a loss of Rs. 298/-

Case 2

Change the Owner Contribution to 25%. Loan will be set to 75%. You will see that for Rs. 250/- pumped in by investor, there is a loss of Rs. 538/- which means it is a comparatively severe loss as compared to Scenario 1.

The first 2 cases cover a period of falling prices.

Case 3

Take a scenario where there is no home loan to finance the real estate investment. Set Owner Contribution to 100%. Automatically loan will be set to 0%. Take year of purchase as 2002 and year of sale as 2007. Scroll down to see your returns in the cells marked in yellow. The Rs. 1000/- put in by investor, grows to Rs. 2414/-. This gives a compounded annual return of 15.8%

Case 4

For the fourth scenario scroll up and set Owner Contribution to 25%. This means bank loan will be 75%. The Rs. 250/- put in by the investor grows to Rs. 1439/-. This gives a stupendous compounded annual return of 33.9%.

Cases 3 and 4 cover a period of rising prices.

Note – Mobile device or tablet users may find that the Excel is seen better in Landscape mode. Rotate your device and give it a try. Alternatively, you can download the Excel and view it in an application in your device.

Summary of real estate investment analysis

- Remember that real estate prices are not like a one way ticket!

- Debt will help increase your returns in good times.

- It will greatly reduce your returns or give you big losses in bad times.

- Make a wise and safe decision when you decide to make a real estate investment.

- Don’t bite off more than you can chew. Don’t be greedy.

- Do not put money that you need immediately in the next 5 years in real estate investments because there can be situations where you cannot take it out without losses.

Click here to download the free Excel for understanding returns on real estate investment.

Excellent stuff! However, I think, this table is not calculating the “Total compounded annual return” accurately.

Many thanks, Anil, for pointing that out. There indeed was an error. I have rectified it. Also, I made the gain calculation part in the Excel simpler.

Appreciate your comment!

Thank for excellent analysis.

Sir,

I am very much interested in stock and real estate investment. I am also joining your e-course .

Can you explain why there was sudden drop in price in 1996?

Can we expect drop like this in future ?

Please upload % report from 1992 to 2013 , so that we can predict future price.

Once again thank you for sharing your knowledge.

Kind regards

Thanks Sonu.

From my understanding there was a speculation led run-up in the pre-1995-6 years. By 1996-1997 interest rates had also shot up. You had 10 year bond yields around 12-14%. Home loans became too expensive. All this led to the real estate sector entering a slump.

About ahead, one cannot predict with certainty. I have been expecting a slow-down for some time but the market defies reality. A large reason for this is the amount of black money sloshing around in our economy. The builder-politician nexus is another reason. They can delay the inevitable.

That is why this article, was written from the perspective of understanding what can happen. I really don’t know what will happen.

Like the famous saying, the markets can stay irrational for a long time.

Hi Kunal,

Great work! Read both the articles, its brilliant.

However please assist me with the updated excel. Compounded return is still not populated correctly.

Thanks,

Chetna

Nice post. This is helpful to take a precaution steps when real estate price crash. Thanks for sharing this post.