Do you want to know about a great example of long-term wealth creation in equity?

Read on!

In which company was the investment made?

VST Industries Ltd.

What is their core business?

Cigarette manufacturing.

Source: Wikipedia

Source: Wikipedia

Moneycontrol has a fascinating article about how Mr. Radhakishan Damani made an incredible investment in VST Industries that has multiplied manifold over the last decade.

How much was invested by Mr. Damani?

Approximately Rs. 63 crore.

When?

In 2001 and in subsequent years.

What is the value of his investment today?

Investment value as of 30 June 2012 – Rs. 685.75 crore

What is the value of dividends received?

More than Rs. 71 crore.

VST Industries – Company snapshot

VST Industries is a cigarette manufacturer. They have brands like Charms, Vazir, Charminar, Moments and Special Extra Filter at the lower-end of the cigarette market.

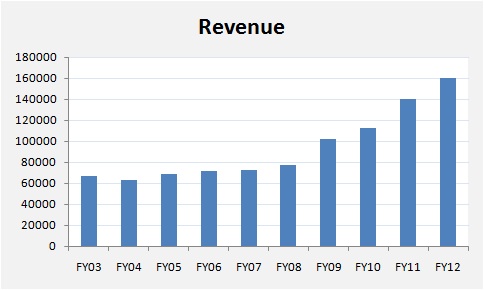

Revenue

Figures are in Rs. lakh.

Source: Annual Report FY12, Capital Orbit

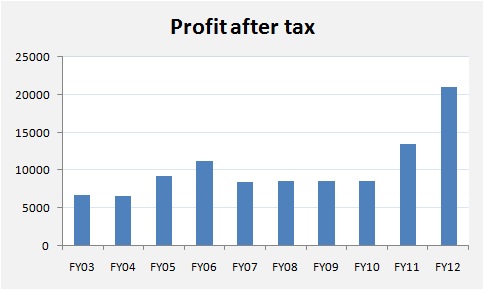

Profit after tax

Profit after tax more than tripled in the last ten years.

Source: Annual Report FY12, Capital Orbit

Return on net worth

The company has great return on net worth ratios.

Source: Annual Report FY12, Capital Orbit

Source: Annual Report FY12, Capital Orbit

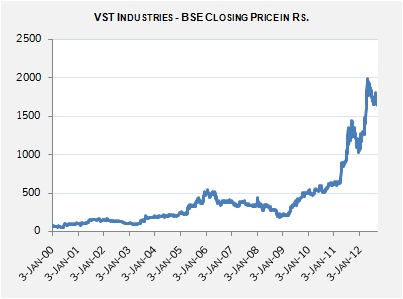

VST Industries Share price

On 3 January 2000, the share price of VST Industries was Rs. 65.85/-

On 14 September 2012, the share price had reached Rs. 1711.35/-

It means capital appreciation of around 26 times in this period!

Moneycontrol Article

Click here to read the Moneycontrol article.

You might have also made a great investment in a sound company. Do share your story with other readers using the comment section below.

I will be sharing an analysis of VST Industries in the near future on Capital Orbit.

Please read the disclaimer.

Additional disclosure: I have an investment in VST Industries.

Are you saying this is a buy and a hold?

Kidakaka – when I wrote this article I already had a position. At the current price I feel that its starting to become cheaper. I have added more at around Rs. 1500 levels today. I feel that it is a good stock to own for the long-term. The dividend gives me comfort. 4.5% is not bad at all. This is a business which has good entry barriers and also relatively inelastic demand. People will continue smoking.

Hi Kunal,

Nice to read about discussions on such multibaggers.

I added 100@1450 last yr & another 100 now@1610 & Im really glad & Im rewarded. My only concern is the low liquidity & future govt pricing. Is it worth to add more. Do you foresee a price of 2000/- soon. Also, kindly let me know what do you feel about VST Tillers, Ingersoll Rand & BASF for long term. Eagerly awaiting your revert Thanks in advance!

Nikhil

Hi Nikhil,

I don’t have a specific view on targets. I think it is a steady business. I have added at multiple points and seen a roughly 23-25% a year compounding in capital value. The 4-5% dividend yield is in addition. At 20 times P/E as it roughly trades at today it is not as juicy as it was earlier. I continue to be invested.

Future govt. policies cannot be predicted. It is a big revenue earner for the government because of the excise duty payouts.

I am ok with the low liquidity as I am not looking to trade in and out of this one.

I am invested in VST Tillers since February 2013. It has been a good investment for me. I continue to hold it too. I have not studied Ingersoll Rand and BASF in detail sufficient for me to share a view. Will check them out.

Please share your thoughts on VST Industries now. Is it still worth adding to it. Excise duty from 11 to 72%. what will be their earning impact. 12% down…hitting almost 52 week low. thanks for your guidance.