You have heard of return on capital. So what do I mean by return of capital?

The phrase Return Of Capital stems from the basic philosophy of avoiding losses. Now, all of us have made some or the other loss in our investing experience. They are inevitable when you invest money in the stock market. The important thing is to know when to cut your losses, especially if its a fundamentally bad company. Because if you wait too long with a falling stock of a dubious company you never know when it will ever recover. And even if it recovers getting your invested amount back is a very tough task.

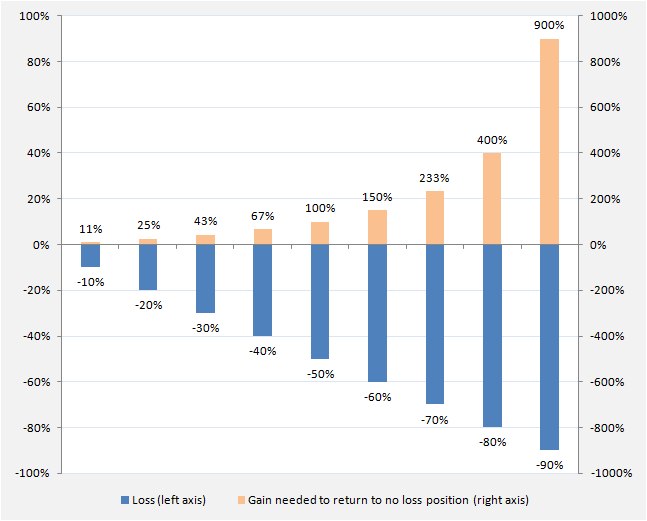

See the chart below.

Very simply, the bigger loss you make, the greater is the gain needed to recover. And the gain needed increases by leaps and bounds with bigger losses.

How does it work? Assume you bought 1 share of XYZ Ltd. at the price of Rs. 100/-. It falls by 10%. Your investment is now worth Rs. 90/-. You need it to rise by Rs. 10/- to reach Rs. 100/- again. 10 divided by 90 works out to 11%. A 10% loss might not hurt so much considering you need a gain of 11% on the investment position.

How does a 60% loss sound to you knowing you need a gain of 150% on the investment position. This time you work the example too.

The gain needed is Rs. 60/- divided by Rs. 40/- (Rs. 100-Rs. 60) which works out to 150%. Literally, the price needs to rise by 150% needs to double from this low point.

With bad investments there is a low chance of such gains. Now you have understood the bleak prospects of seeing the original money you put in with increasing losses.

Warren Buffett needs no introduction. He is one of the gurus of stock investing for a good reason. He has an exemplary track record of making steady long-term investments that have multiplied manifold over many years. One of his famous quotes goes,

Rule No. 1: Never Lose Money. Rule No. 2: Never Forget Rule No. 1.

So, look first for return of capital. Avoid greed in the hope for fantastic returns. Avoid bad stocks. Once their prices crash you have low chances of getting your money back.

You can forget extra returns on capital when there is no return of capital.

Leave a Reply