Individual – Revenue and expenditure

An individual like you and me earns money through the year usually from salaries, from a business income or by selling an asset like a house or stocks. We spend money on basic needs of food, clothing, and shelter, goods like TVs and motorcycles and on services ranging from haircuts to travel agents. Usually most of us end up saving some money which we invest in real estate, stocks, fixed deposits or bonds.39B27SKK6VU6

Government – Revenue and expenditure

Similarly, the government has receipts usually from income taxes, excise duties, custom duties and surcharges that individuals and companies pay. The government earns also from selling assets. What assets does the government have? There are multiple examples like telecom spectrum, coal blocks or land. The government can sell its stake in public sector companies to the public and foreign investors. Recall how the government asked NTPC to do an IPO in 2004.

The government spends money on goods ranging from food grains to rifles and ammunition for the armed forces, various services and infrastructure for its citizens like postal services, water, sanitation and roads. An important spending item is salaries to government employees and pensions to retired government employees.

If the Government of India (or for that matter any other government of another country) spends more than it earns we have a situation which is called a fiscal deficit.

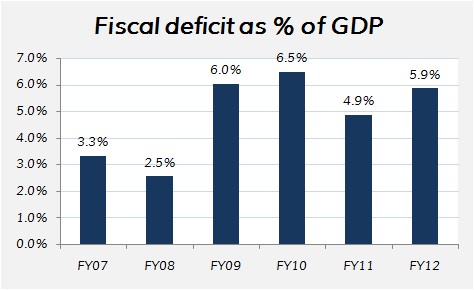

Fiscal deficit of India to GDP

Most newspapers and magazines talk about fiscal deficit as a percentage of GDP. GDP is the market value of all final goods and services produced in a country in a year. The GDP number includes both government spending and private consumption of goods and services. The chart below is that of fiscal deficit of India to the GDP over the last 6 years.

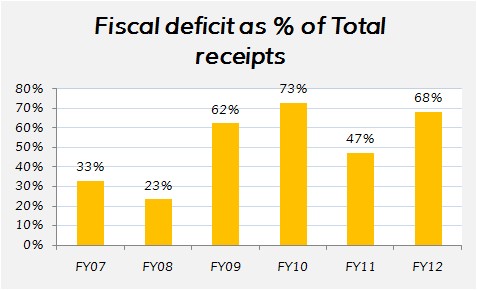

Fiscal deficit of India to total government receipts

It is quite useful to look at the government only as a standalone entity and see its receipts and expenditures in a year and see the size of the fiscal deficit. The chart below shows fiscal deficit of India as a percentage of the total receipts of the Government for the last 6 years respectively.

What does it mean practically?

Imagine you earned Rs. 100/- in financial year 2012 and spent Rs. 168/-. That is exactly what the 68% bar in the chart above is similar to. The Government of India spent 68% more than it earned in FY2012.

You might wonder whether this is a good practice or not. In the next article I will explain what impact this has on borrowing needs of the government.

Update:

If you liked this article, read the next part about Government borrowings. Click here.

This introduction is a simplistic yet important one. The one needed by people to understand the mess. Looking forward to the second article in the series.

Thanks Vikesh, the second article is up!

Concept wise okay but i have a naive doubt … how is the govt able to spend in surplus year after year ??? where is it getting the surplus amounts from ???

Hiren – The government finances are in deficit mode for the entire period shown. We do not have a surplus.

I am not sure of what you are asking, but the answer is probably this.

The figures of Rs. 100 and Rs. 168 that I mentioned in the post are total figures for earning and spending in the entire year. This extra Rs. 68 has to be borrowed through the year, so that a total of Rs. 100 + Rs. 68 can be spent.

If this is not what you were asking, do let me know.